Momentum towards climate action is growing. More than 90% of the world’s economy has pledged to achieve net zero emissions.

Some have gone even further than net zero. Leading companies including Drax, Microsoft, IKEA and Intuit have pledged to be carbon negative by 2030.

To meet these commitments, companies must aggressively reduce the carbon dioxide (CO₂) and other emissions within their value chain, as defined by the Greenhouse Gas Protocol.

As organizations reduce their emissions, they’ll likely find residual emissions outside their control. These could be Scope 3 emissions or hard-to-abate emissions. Hard-to-abate emissions are those that organizations can’t reduce. This could be due to lack of technology available, or prohibitive cost.

The Science Based Targets initiative (SBTi) Net-Zero Standard recognizes companies are likely to have residual emissions beyond reduction. This is where high-quality carbon removals can help. Organizations can counterbalance residual emissions they can’t reduce or remove to achieve net zero and beyond.

The Voluntary Carbon Markets Integrity Initiative (VCMI) encourages organizations to follow criteria on the credible use of carbon credits as part of their climate commitments. This includes selecting high-quality carbon credits in accordance with the ICVCM’s core carbon principles.

What do we mean by high quality carbon removals?

When evaluating the quality of carbon removal projects, we consider how much climate benefit they provide. Criteria to consider are:

- Permanence: How is the captured CO₂ stored (and for how long)? What’s the risk of reversal – the possibility that the stored CO₂ will be re-emitted into the atmosphere?

- Measurement, reporting and verification: Is the CO₂ removal accurately measured? Are they using a reliable methodology verified by independent bodies?

- Sustainability: Besides capturing CO₂ emissions, does the carbon removal method offer any additional climate, environmental, or social benefits?

Drax uses bioenergy with carbon capture and storage (BECCS) technology to generate renewable electricity and capture carbon dioxide. This process uses sustainable biomass as the combusted fuel.

Sustainability underpins all BECCS projects at Drax. This ranges from the start of the process – sourcing the biomass from highly-regulated, sustainably-managed forests – to the end: the generation of renewable electricity. We generate that power through the combustion of biomass, capturing and permanently storing the CO₂ emissions produced during the process and conservatively quantifying the amount of carbon removed. In addition, the economic, social and biodiversity benefits associated with BECCS – delivering positive outcomes for people near to our operations, nature and the climate – are also sustainable.

BECCS is a hybrid carbon removal solution. It uses both natural processes (CO₂ being absorbed from the air in the sustainable forests that are the source of the biomass) and engineered technology (the CO₂ captured, thanks to a chemical process, during generation).

As pioneers of this critical BECCS technology, Drax is working with the carbon credits industry to support the development of high integrity standards for carbon removals. With these standards in place, the carbon dioxide removals (CDRs) resulting from BECCS will be independently measured and verified to provide robust assurance of their high quality.

Drax Carbon Removals, delivered through BECCS, are available to organizations that want to address residual emissions and be confident that the investment is delivering real climate benefits.

A diverse carbon portfolio mitigates risk

Carbon removals are associated with a variety of approaches, geographies, and co-benefits. Buyers should seek to leverage these differences and mitigate risks through purchasing a range of solutions, building CDR portfolios that are diverse and of a high quality.

This quality is the unifying factor in any portfolio. Including credits such as Carbon Removals – from a high-quality project like BECCS – will ensure that the portfolio’s robust and anchored in permanent, quantifiable carbon removals.

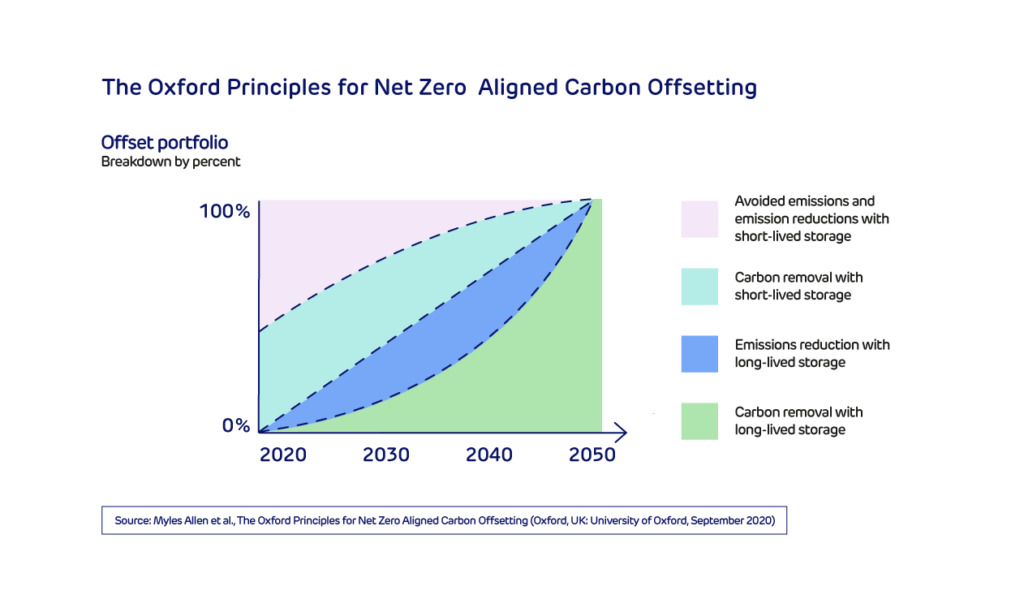

As per the Oxford Principles, an organization’s carbon portfolio should change as their decarbonization strategy develops. As they reduce more emissions, they should have less short-lived storage (like reforestation credits) and more long-lived storage (like BECCS).

Forward-thinking companies are embracing carbon removals

Through a diverse portfolio, organizations are also supporting the growth of an essential carbon removals market comprising a range of solutions that span nature-based and technological approaches. Corporate action through the carbon market is necessary to scale these solutions, and to tackle the climate crisis.

Leading companies like Alphabet, J.P. Morgan and Stripe are already embracing carbon removals and making them a key component of their climate strategy. The last three years has seen the carbon removals market grow to nearly $400 million. Among the largest deals is Respira’s agreement to purchase up to 2 million metric tonnes of Drax Carbon Removals.

Now is a pivotal time for climate action and innovative businesses must grasp the opportunity. They should secure high-quality carbon removals to support their decarbonization goals, and to forge the path to a climate positive future.